JHVEPhoto

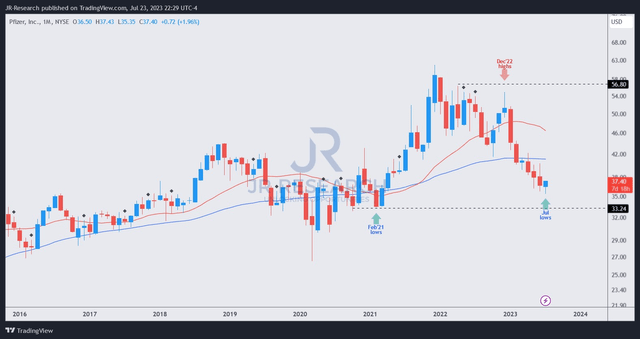

Pfizer Inc. (NYSE:PFE) investors have likely been baffled by the market’s battering as it fell toward lows last seen in early 2021. I gleaned that dip buyers attempted a mean-reversion opportunity in May 2023 but were rejected by sellers. Given the relative underperformance of PFE and its healthcare peers (XLV), underlying sector rotation occurred as investors chased alpha in the AI hype train.

As such, biopharma leaders like Pfizer aren’t expected to escape the rotation unscathed despite its wide economic moat. Moreover, investors are likely still pricing in its COVID vaccine revenue hangover, which affected its near-term growth metrics (Seeking Alpha’s Quant growth grade is an “F”). I also assessed that healthcare investors likely rotated to chase the surge in companies with significant exposure to weight-loss drugs, like Novo Nordisk (NVO) and Eli Lilly (LLY).

Both companies are reportedly “facing challenges in meeting the demand for their weight-loss medications,” as NVO and LLY outperformed their sector peers. These companies have robust growth grades rated highly by Seeking Alpha’s Quant, with both rated “A-.” However, their valuations are also no longer attractive for investors who didn’t add exposure late last year, receiving an “F” valuation grade.

With that in mind, weak dip buyers in PFE have likely been spooked, as it proved to be a falling knife over the past few months. However, investors must assess whether PFE is at or close to peak pessimism, even as these investors bailed out.

The company is slated to report its second quarter or FQ2 earnings release on August 1. Investors will also likely assess the operational impact as a result of the tornado that afflicted its Rocky Mount manufacturing plant recently. Initial assessment suggests that while its warehouse facilities were damaged, the company is “actively moving products to other nearby sites for storage and sourcing alternative manufacturing locations.” Furthermore, last week’s robust buying sentiments corroborate my view that buyers weren’t unduly concerned with the matter.

Despite that, the market’s pessimism over the company’s ability to replace the revenue from its products approaching patent cliffs is justified. The revised analysts’ estimates suggest that Pfizer’s 4Y revenue CAGR from FY23-27 is expected to be nearly flat to slightly negative. While its adjusted operating profit is expected to grow by a 4Y CAGR of 1.8%, it likely isn’t going to excite growth investors.

While PFE trades at a forward dividend yield of 4.41%, income investors have plenty of less risky choices currently, as the 2Y Treasury yield last printed at 4.86%. As such, I believe Pfizer will need to depend on value investors to return confidently in buying PFE’s significant battering.

Therefore, the critical question facing PFE holders is whether its price action has reflected such an opportunity?

PFE price chart (monthly) (TradingView)

I assessed that a possible long-term bottom in PFE could be validated by the end of July. It’s the first robust bullish reversal price action since it lost its mean-reversion opportunity in March 2023.

With PFE’s valuation graded “A-” by Seeking Alpha’s Quant, it isn’t aggressively configured. Therefore, the improved dip buying sentiments should help encourage more value investors to return. Moreover, with the Fed close to its peak rate hikes, a possible pivot moving forward should narrow the spread between PFE and other yield-driven products, attracting income investors back into the fray.

Despite the relatively pessimistic analysts’ estimates, the market seems to have positioned it for a disappointing Q2 release, lowering the bar for Pfizer to offer a more assured outlook. As such, PFE holders looking for an opportunity to buy more discounted shares should consider adding more at the current levels.

Rating: Maintain Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.