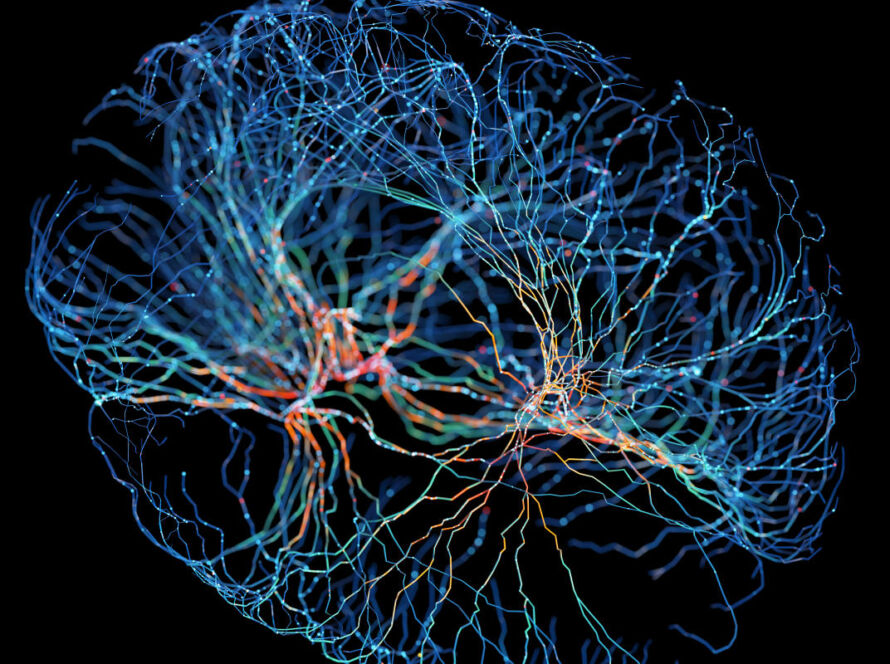

Salt Lake City-based Recursion Pharmaceuticals is revolutionizing the field of drug discovery by harnessing the power of artificial intelligence (AI). Using AI-powered models, Recursion Pharmaceuticals can identify new experimental drug candidates with great accuracy and efficiency.

Despite the struggles faced by the healthcare sector in the stock market this year, small stocks that incorporate AI technology are defying the trend and experiencing significant growth. The S&P 500’s healthcare sector has seen little change, while the broader index has advanced by 19%, marking the largest underperformance for the sector since 1993.

Investors have shifted their focus towards speculative investments, such as technology companies, meme stocks, and cryptocurrencies, leaving behind more defensive sectors like healthcare. However, companies at the forefront of the AI revolution, such as chip maker Nvidia and tech giant Microsoft, have emerged as the top-performing stocks this year.

This surge in enthusiasm has provided a major boost for smaller biotech companies, where investors prioritize growth opportunities over current financial results. Recursion Pharmaceuticals’ stock, for instance, has more than tripled since May. The company’s AI-powered models have attracted attention from investors, and it recently received a $50 million investment from Nvidia. Recursion Pharmaceuticals also plans to license its models to other drugmakers, facilitating their own drug discovery efforts.

Other technology companies implementing AI in their processes have also experienced significant growth. Schrodinger’s stock is up 162% this year as they sell AI-enhanced software for drug development. Diagnostic imaging firm RadNet, utilizing AI for mammogram interpretation, saw an 80% increase in stock value. Similarly, U.S.-listed depository receipts of cancer drug developer Exscientia are up 51%. Collectively, these four companies have a market value of approximately $9.3 billion.

Despite not consistently earning profits from their AI-related businesses, these companies now command premium valuations due to the belief that sales will rapidly grow. For example, Recursion trades at 60 times its last 12 months of revenue while Schrodinger trades at 18 times. In comparison, the S&P 500 trades at 2.5 times its revenue.

With the U.S. spending about $4.3 trillion annually on healthcare, the incorporation of AI is seen as a promising solution for improving efficiency and advancing drug discovery. Industry executives and investors recognize the potential for AI to revolutionize the healthcare sector and drive significant growth in the coming years.